Paytm, renowned as one of the most preferred payment methods among Indian online casino players, has made significant strides by filing for an Initial Public Offering (IPO), a move that has stirred considerable anticipation within India’s financial landscape. This IPO is poised to become one of the largest, if not the largest, in the country’s recent history, with analysts projecting its occurrence around the festive season of Diwali later this year.

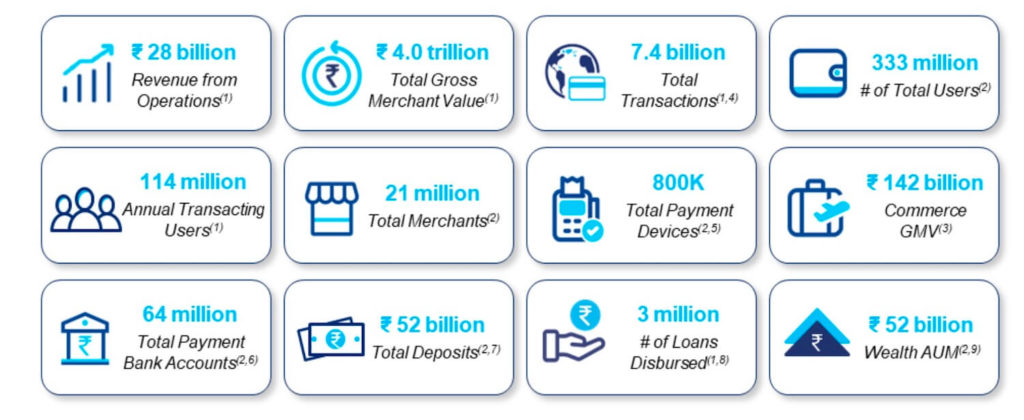

In its IPO filing, Paytm unveiled a series of impressive metrics that underscore its prominence in the Indian market. With a staggering user base exceeding 333 million, out of which 114.3 million engage in annual transactions, and a network spanning over 21 million merchants, Paytm has firmly entrenched itself as a cornerstone of the nation’s digital payment ecosystem since its inception in 2009 under the stewardship of CEO Vijay Shekhar Sharma.

The valuation of Paytm, soaring beyond the $16 billion mark, attests to its status as one of India’s most valuable companies, a position fortified by strategic investments from industry giants such as Alibaba, ANT Group, and Softbank. The forthcoming IPO is poised to mobilize substantial capital, estimated at over $2.2 billion, which is poised to fuel the company’s ambitious growth plans and fortify its competitive edge in the ever-evolving fintech landscape.

Forecasts for the post-IPO era envision a slew of initiatives aimed at bolstering Paytm’s market presence and enhancing its service offerings. These initiatives include the rollout of innovative features, forging new partnerships with merchants across diverse sectors, and exploring potential acquisitions to augment its portfolio.

Despite facing formidable competition from established players like Google Pay and PhonePe, Paytm’s robust market position and formidable financial backing position it favorably for sustained growth and dominance in India’s burgeoning fintech sector. As the company embarks on its IPO journey, it signals a pivotal moment not only for Paytm but also for India’s digital payment ecosystem, heralding a new chapter of expansion, innovation, and market leadership.